Market Snapshot

Jackson Hole

The Jackson Hole Economic Symposium in Wyoming was widely anticipated by markets, with Fed Chair Jerome Powell delivering the keynote address at 10:00 A.M. on 26th August. Powell rocked up with a deadly one-two, warning that the fight against inflation will bring some ‘pain’ to households and businesses in addition to the unemployment rate inching up.

His remarks rattled equity markets as the major indices plunged more than 3%, with both S&P 500 and Nasdaq Composite suffering their largest daily decline since mid-June. Surprisingly, the reaction in U.S. 10Y yield was muted but the Dollar Index jumped to 108.84 during Powell’s speech. Here are some of the key excerpts.

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

Inflation is running well above 2 percent, and high inflation has continued to spread through the economy. While the lower inflation readings for July are welcome, a single month's improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down.

We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.

GDP & PCE

The second estimate for Q2 GDP points to a decline of 0.6% QoQ, a slight improvement from the advance estimate which indicated a contraction of 0.9% in early August. The second estimate primarily reflects upward revisions to consumer spending, private inventory investment, and state and local government spending that were partly offset by downward revisions to residential fixed investment, federal government spending, and exports. Imports were revised down.

The PCE Index1 for July printed at 6.3% YoY, half a percentage point lower than last month's reading. Prices for goods increased 9.5% (10.4% in June) and prices for services increased 4.6% (4.9% in June) whilst food prices increased 11.9% (11.2% in June) and energy prices increased 34.4% (43.5% in June). Although it’s still early days, signs of inflation peaking are beginning to take root.

Flash PMIs

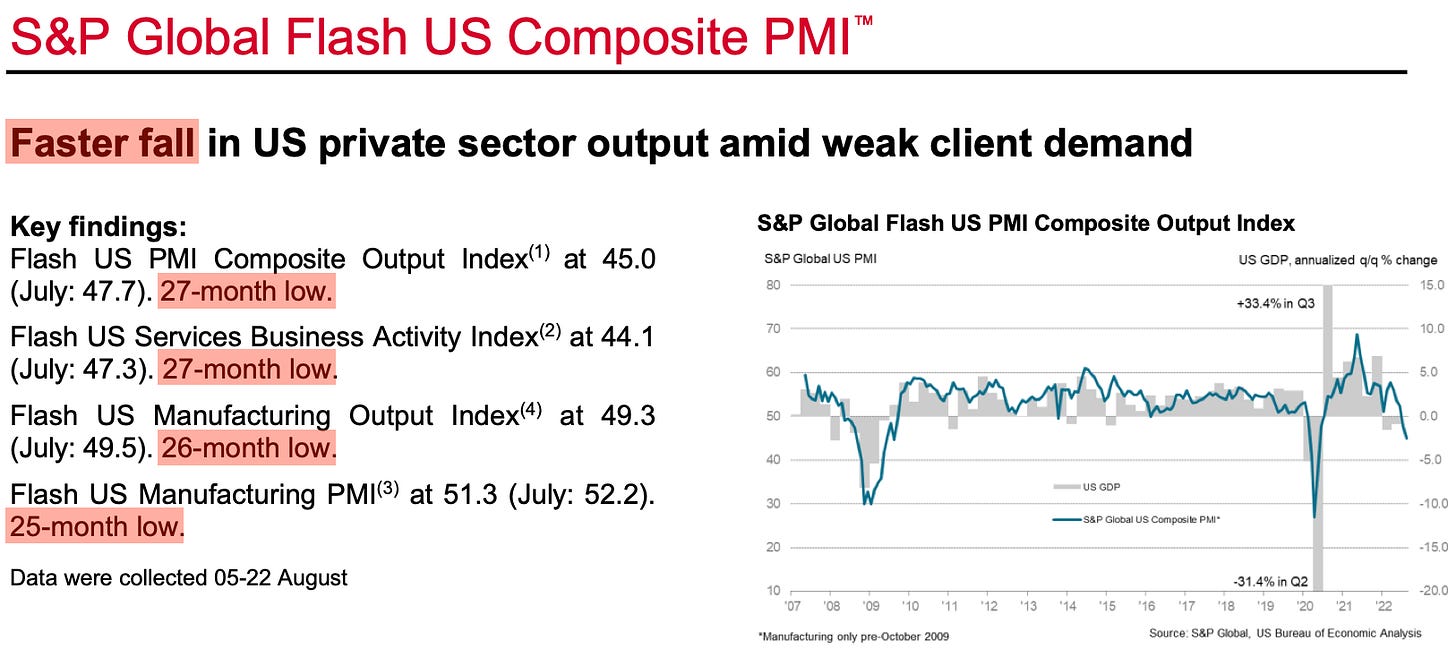

The Flash Composite PMI Index contracted for the second consecutive month with all sub-indices printing at 25-month lows or more. The only sub-index printing in expansion territory was the Manufacturing PMI; even then operating conditions remain subdued amid muted demand conditions and production cutbacks.

August flash PMI data signalled further disconcerting signs for the health of the US private sector. Demand conditions were dampened again, sparked by the impact of interest rate hikes and strong inflationary pressures on customer spending, which weighed on activity. Gathering clouds spread across the private sector as services new orders returned to contractionary territory, mirroring the subdued demand conditions seen at their manufacturing counterparts. Excluding the period between March and May 2020, the fall in total output was the steepest seen since the series began nearly 13 years ago.

“Lower new order inflows and continued efforts to rein in spending led to the slowest uptick in employment for almost a year. Reports of challenges finding suitable candidates started to be countered by those companies noting that voluntary leavers would not be replaced with any immediacy due to uncertainty regarding demand over the coming months.

“One area of reprieve for firms came in the form of a further softening in inflationary pressures. Input prices and output charges rose at the slowest rates for a year- and-a-half amid reports that some key component costs had fallen. Although pointing to an ongoing movement away from price peaks, increases in costs and charges remained historically robust. At the same time, delivery times lengthened at the slowest pace since October 2020, albeit still sharply, allowing more firms to work through backlogs.”

Durable Goods

New orders for durable goods stalled in July, breaking a four-month streak, as economists had expected an increase of 0.5% after June’s gain of 2.2%. This fall in new orders for goods follows the second month of contraction in the new orders index for July’s ISM Manufacturing PMI reading.

In addition, the new orders index from the flash PMI report above also indicates weakening demand for both manufacturing and services sectors, putting further pressure on August’s reading for durable goods.

New Orders

New orders for manufactured durable goods in July decreased less than $0.1 billion or virtually unchanged to $273.5 billion, the U.S. Census Bureau announced today. This decrease, down following four consecutive monthly increases, followed a 2.2 percent June increase. Transportation equipment, down following three consecutive monthly increases, drove the decrease, $0.6 billion or 0.7 percent to $93.0 billion.

Shipments

Shipments of manufactured durable goods in July, up fourteen of the last fifteen months, increased $1.0 billion or 0.4 percent to $270.5 billion. This followed a 0.3 percent June increase. Transportation equipment, up nine of the last ten months, drove the increase, $1.0 billion or 1.1 percent to $86.3 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in July, up twenty-three consecutive months, increased $7.9 billion or 0.7 percent to $1,126.5 billion. This followed a 0.8 percent June increase. Transportation equipment, up seventeen of the last eighteen months, led the increase, $6.7 billion or 1.0 percent to $655.2 billion.

Inventories

Inventories of manufactured durable goods in July, up eighteen consecutive months, increased $1.1 billion or 0.2 percent to $486.2 billion. This followed a 0.4 percent June increase. Machinery, up twenty-one consecutive months, led the increase, $0.7 billion or 0.8 percent to $84.0 billion.

Capital Goods

Non-defense new orders for capital goods in July increased $2.4 billion or 2.8 percent to $87.3 billion. Defense new orders for capital goods in July increased $1.2 billion or 8.7 percent to $14.6 billion.

Earnings

Zoom missed revenue estimates but beat EPS with revenue growing just 7.8% YoY whilst net income dived 85.6% YoY. Despite continued top-line expansion and strong Enterprise performance, this was the second consecutive quarter of (net income) decline as profit margins were heavily compressed.

Revenue was predominantly impacted by the strong U.S. dollar and performance of the Online business2. Guidance for Q3 was also lowered with the stock falling 8.3% in after-hours trading on 22nd August and is currently down 55.8% YTD.

Not only did Palo Alto Networks beat top and bottomline estimates, the company also achieved profitability for the first time in four years. Revenue and billings3 grew 27.2% and 43.9% respectively YoY whilst non-GAAP net income grew 56.9% YoY.

Next-Generation Security growth, driven by rapid pace of innovation and strong sales execution, was the primary driver for earnings in Q2. The board also approved a three-for-one stock split that will take place in a few weeks on 14th September; its share price jumped 8.2% in after-hours trading on 22nd August.

Macy’s exceeded Q2 net sales and earnings expectations but lowered full-year sales and EPS guidance on increased macroeconomic pressures. This was mostly due to excess inventory that would require steep discounts to move for the remaining two quarters, similarly to what Target had done but only earlier in Q2. Net sales and net income both declined, falling 0.8% and 20.3% respectively YoY. Its share price closed 3.8% higher on the day of earnings results but is down 32.5% YTD.

“We have seen declining retail traffic and areas of weakening apparel sales over the quarter as the consumer faces higher costs on essential goods, particularly grocery,” Macy’s CFO Adrian Mitchell said.

NVIDIA missed top and bottomline estimates with revenue growing just 3.0% YoY but falling 19.1% QoQ whilst net income cratered 72.4% YoY and 59.5% QoQ. Breaking down the revenue segments, the Gaming and Data Center markets are their two largest cash cows.

Gaming disappointed massively with revenue tumbling 33.3% YoY and 43.6% QoQ; one of they key reasons for its downfall is crypto mining or rather, the lack of mining activity. A double whammy of a ‘crypto winter’ coupled with surging utility costs have weighed heavily on mining activity that has resulted in plummeting demand for GPUs.

On the other hand, Data Center revenue grew 60.1% YoY but just 1.5% QoQ. Moving forward, the Data Center segment is likely to overtake Gaming as its largest revenue source until utility bills turn south and mining activity awakens from its slumber. As expected, revenue guidance for Q3 was also lowered. Its share price fell 4.6% in after-hours trading on 24th August and is down 46% YTD.

Salesforce announced strong Q2 results, beating both top and bottomline estimates. Revenue grew 21.8% YoY but net income cratered 87.3% YoY; profit margins have been compressed for the last three earnings results. In addition, revenue guidance for Q3 was lower than market estimates as a strong dollar and ‘measured’ purchases from customers are expected to make a dent in full-year revenue.

The company also announced its first-ever share buyback plan, amounting to $10 billion. Its share price fell 6.7% in after-hours trading on 24th August and is down 35.3% YTD.

Snowflake beat revenue estimates, rising a whopping 82.7% YoY, but missed on EPS despite non-GAAP gross margin increasing by 75% YoY. Total customers hit 6,808, growing 36.4% YoY, with a NRR rate of 171%. The company has yet to show any signs of profitability, with a TTM net income loss of $169 million.

Its share price jumped 17.2% in after-hours trading on 24th August on the back of strong Q3 and full-year guidance, increasing revenue, solid RPO figures and customer growth but is still down 40.5% YTD.

Closing Out

Equity markets hit a major speed bump on Friday following Powell’s address at Jackson Hole. The CME FedWatch Tool is now forecasting a higher probability of a 75-bps hike over the 50 for September’s FOMC meeting. Although he was uber-hawkish, bond yields did not seem to get the message.

Yields are likely to shed more clues on the market’s direction over the next few weeks together with upcoming inflation data points. If bonds continue to sell off next week and the U.S. 10Y yield heads to 3.100% and above, equities, especially tech, could re-test the lows of mid-June.

Readers can also keep up with the latest insights by clicking on the button below.

Disclaimer: Views, thoughts, and opinions expressed in this newsletter belong solely to the author and the information contained in said newsletter should not be construed as investment advice. This newsletter acts as a publisher of financial information, not an investment advisor.

The Fed’s preferred measure of inflation

Zoom defines Enterprise customers as distinct business units who have been engaged by either Zoom’s direct sales team, channel partners or independent software vendor partners; all other customers are referred to as Online customers.

Palo Alto Networks defines billings as total revenue plus the change in total deferred revenue, net of acquired deferred revenue, during the period. The company considers billings to be a key metric used by management to manage the company's business and provide investors with an important indicator of the health and visibility of the company's business.